Table of contents:

The Importance of SaaS KPIs

No matter what industry you come from, whether it is sales, marketing, customer success, or something else, there is data you can track. For most companies, it is incredibly vital that they can visualize their KPIs easily and transparently. This can be done by using a dashboard like the one Plecto offers, as it can be crucial for a company's performance —as long as they know which KPIs to track!

With a flood of data opportunities, it doesn't take long before you're submerged in waves of metrics and corresponding acronyms like customer acquisition cost (CAC), annual recurring revenue (ARR), lifetime value (LTV) — and these are just the most used ones. For new ones in the business, finding the best KPIs can be like searching for a needle in a haystack.

The question is, therefore, which of these metrics can you reliably turn to, to see if your investment is a failure or a success? Well, simply put, it depends on many factors. That's where this blog post comes in — we've done the hard work so you can spend more time doing what you do best... providing the best SaaS tools!

So, what exactly are KPIs and how should my SaaS team use them?

A Key Performance Indicator (KPI) is a term for any of the metrics that are the most critical to track for a company's performance against its objectives. Hopefully, this sounds familiar to you. If not, then you're in for a treat.

The challenge with KPIs is that there are dozens of metrics that can be measured. If you're new to KPIs and reviewing metrics, you might think that you should be tracking all the available KPIs. That won't be a good idea since monitoring them all is neither productive nor efficient. Furthermore, without an excellent program to combine and visualize your KPIs, it will be an impossible task to keep track of all your data.

Fear not! This blog post is going to help you keep focus. Below, you will find 10 KPIs that every SaaS entrepreneur and team should be monitoring and analyzing to perform better. So here's the list — these are the 10 most important SaaS KPIs you should focus on:

- Churn Rate

- Monthly Recurring Revenue (MRR)

- Revenue Churn

- Annual recurring revenue (ARR)

- Committed Monthly Recurring Revenue (CMRR)

- Cash

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLV)

- Lead Velocity Rate (LVR)

- Net promoter score (NPS)

1. Churn Rate

The first one is, perhaps, the most obvious. However, that doesn't always mean that SaaS companies remember to check up on it. For a SaaS distributor or any other company that works with subscribers, customer churn rate is essential since it shows the percentage of customers or subscribers lost.

Too many SaaS businesses choose to overlook this number in favor of more detailed or derivative metrics — and that's a huge mistake. The most important thing for every SaaS company is to retain existing customers while also onboarding new ones. If your typical customer does not stick around long enough for you to earn back what you spent to acquire them (CAC), then you're in trouble. The logic here is pretty straightforward: If you want to create revenue growth, then it is equally important to maintain your existing customers and acquire new ones.

Here's how you can calculate your churn rate:

2. Monthly Recurring Revenue (MRR)

Monthly recurring revenue (MRR) is a simple but powerful metric that tracks new sales, upsells, renewals, and churn every month. If churn is not the most important KPI for your company, then MRR certainly is. Say goodbye to manually counting the number of hours you spend working for a client once you've acquired them — MRR takes care of this for you! Growing SaaS companies tend to lose sight of their secured monthly revenue flow, and instead focus on bookings and revenue numbers.

Monthly recurring revenue has many significant business benefits. Building your SaaS company after your MRR growth is an excellent way to get things started. For SaaS companies, MRR helps to keep the focus on the present and allows them to track how the business is growing. Tracking MRR can also assist companies in prioritizing long-term contractually booked sales over the short-lived ones.

Use the following formula to calculate MRR:

3. Revenue Churn Rate

More important to track than the customer's churn rate is the revenue churn rate. This KPI essentially measures your company's loss of revenue, while also evaluating the outside impact some customers might have over others.

This KPI is particularly critical if you operate with a variable subscription price that is dependent on the number of licenses a customer pays for. You will notice some particular correlations between customer churn rate and monthly revenue churn rate. However, there is likely to be some variation among buyers that generate more revenue than others. It's for this reason that you should track MRR and churn rate jointly so that you can dedicate your efforts toward keeping your most valuable customers!

At a minimum, you should be tracking your revenue churn rate quarterly. But if you really want to optimize your revenue, aim to calculate this KPI monthly!

4. Annual Recurring Revenue (ARR)

This is essentially just an extended version of the second KPI on the list, MRR. Is that cheating, or is it just being efficient? We'll let you decide!

You can calculate annual recurring revenue (ARR) by multiplying your MRR by 12 months. Some SaaS businesses choose to calculate their MRR and ARR manually, but most companies nowadays have a system that calculates SaaS metrics in real-time.

Recurring revenue is what makes the SaaS business model so enticing to founders and investors. Customers will continue to pay you as long as you make them happy by providing value through your service. When it comes to determining prices in new companies, instead of settling on one price and locking it in, try different prices each quarter and adjust according to what worked best. That way, you can be certain about how much your customers value your business, and ascertain their satisfaction with your product — ultimately so that your SaaS company can keep on growing.

Here's the formula to calculate ARR:

5. Committed Monthly Recurring Revenue (CMRR)

A modified version of MRR is committed monthly recurring revenue (CMRR). The difference between MRR and CMRR is that the former refers to the total revenue expected from customers every month, whereas the latter takes into account new bookings, cancellations, and downgrades.

Ultimately this KPI aims to show what a SaaS company's revenue would be in the future if the business halted its sales and marketing efforts. It is a particularly useful metric for forecasting future revenue and gives SaaS companies a much clearer picture of their company's financial climate than other more standard revenue metrics.

CMRR is calculated by taking your existing MRR (aka from last month), adding new known bookings, and subtracting known cancellations and downgrades. In this regard, CMRR provides a better picture of a SaaS company's actual financial position than MRR since it also calculates anticipated churn for the time period you are measuring.

Since MRR does not account for expected cancelations, upgrades, and downgrades, it is better for providing a gross overview of revenue — so you can use either MRR or CMRR depending on what it is you are seeking to achieve.

For SaaS companies who sell their subscriptions annually, this metric could be adjusted to calculate committed yearly recurring revenue (CARR).

6. Cash

Often overlooked, this metric may seem simple but money is one of the more exciting KPIs for SaaS businesses. "Why," you ask? Well, because it takes time and funding to come up with a great product and the repayment on that investment will occur over a long time. SaaS founders, like most other companies, must be aware of their cash reserves. If they fail to do so, then they're going to end up overspending, and the company may need outside financing to survive.

Cash can be a difficult KPI to track — particularly in B2B where most transactions are recurring invoices or based on subscription services. Nonetheless, it's crucial to keep on top of your cash flow and understand fluctuations. Whether it's a metric like cash or a KPI requiring complex calculations, you will gain incredibly beneficial insights into your individual, team, and business performance by measuring your most important metrics. So, they need to be understood by those using them — and most beneficial when visualized!

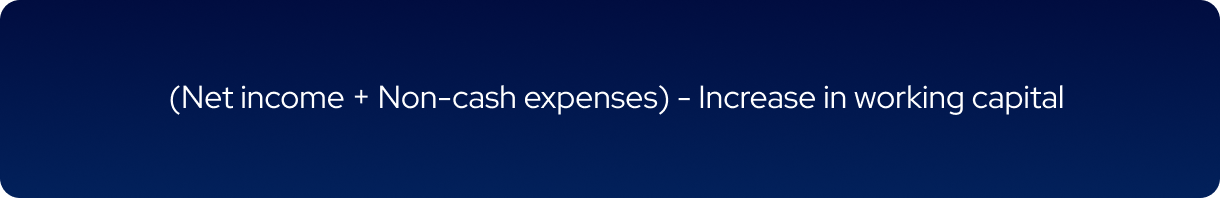

Here's the formula for a common cash-focused metric, OCF (Operational Cash Flow):

Too many companies choose to keep their data secret and only discuss it within management. This is the first mistake. After all, how can you expect your employees to take responsibility for their performance when they don't even know how they're performing?

The leading companies are those that are transparent and open about their KPIs and business performance — drawing their employees' attention to them and presenting them in a comfortable and useful way. This is what we do here at Plecto!

One such way of doing this is by using custom-made dashboards that make complex data easy to understand by presenting your most important KPIs in visual forms like tables, pie charts, and graphs. It's important to remember that you should only should relevant KPIs in an easily digestible way, so your employees don't get overwhelmed and confused.

The following is an example of a data visualization dashboard you can customize to show all your important KPIs to the people you want to see them!

7. Lead Velocity Rate (LVR)

Executives of a SaaS company need to look at the future income possibilities. Lead velocity rate (LVR) is a metric that quantifies your business' growth in terms of qualified leads. That is, how many potential customers are currently in your pipeline to convert to actual customers.

The general problem with most sales metrics is that they are historical (based on old data). Who wants to be focusing on outdated data when you need to make actionable decisions that will gain you that competitive advantage.

This is why LVR is an important KPI you should be focusing on if you want to propel your team's performance to new heights!

LVR is calculated as a percentage, and factors in the variation in qualified leads across different time periods.

Build your first dashboard.

Start your 14-day free trial today

8. Customer Acquisition Cost (CAC)

Now, not all metrics in this blog post are exclusive to SaaS companies but that certainly doesn't detract from their value — they simply should be used to best suit your company's business goals, challenges, and needs. Customer acquisition cost (CAC) is no exception.

This valuable KPI measures the cash that a business spends to acquire new customers. CAC indicates how long it will take a company to earn a return on the investment it took to acquire those customers — a metric known as the CAC payback period.

CAC takes into account the amount companies spent on sales, marketing, overheads, and any other associated costs of growing their clientele. So, this KPI can help SaaS companies assess their spending, and whether they can afford increases in marketing spending, for example.

In fact, this metric can help to determine future business goals and activities since it could indicate that a change in price, more sales, or expense cutbacks are necessary. Ultimately CAC speaks to a company's economic viability and efficiency.

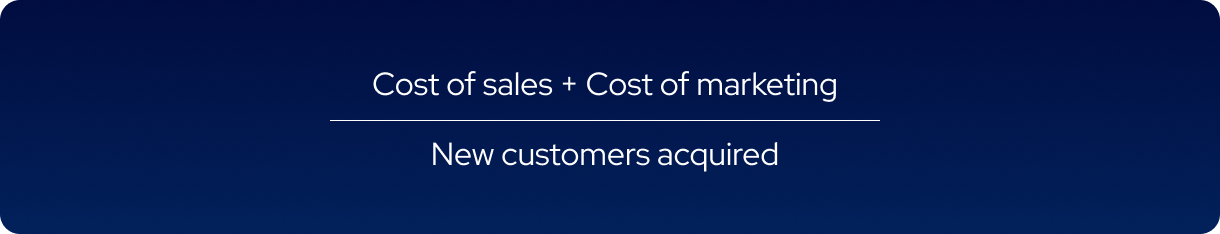

Calculating CAC involves dividing all marketing expenses, personal salary, sales costs, etc. spent on acquiring customers by the number of customers acquired during the tracking period. The formula is as follows:

9. Customer Lifetime Value (CLV)

Now that you know what CAC is and why you should measure this metric, it's time to turn your focus to customer lifetime value (CLV). This KPI reflects the total income a business can expect to earn from a customer over the entire duration of their business relationship.

When tracking CLV, you should keep an eye on CAC, too. At no time should a SaaS company's CAC be higher than its average CLV. If so, the business is in real trouble. Essentially, this means that the company is spending more money to acquire a customer than they are earning from them — and we all know that it is not smart.

CLV is a more advanced way to look at a SaaS company's financial situation that often relies on other KPIs to calculate it. You'll need to have an understanding of your customers' average purchase value, average purchase frequency rate, and average lifespan. It can be complicated, but the main thing to remember is that if your CLV is higher than CAC, then you're good to go — keep up the amazing work!

If you want to really excel, a good rule of thumb is that your CLV should be four times the value of your CAC. To do so, SaaS companies can implement models that focus on using the money they earn from existing customers to acquire new ones.

To get there, use the following formula to calculate your CLV:

10. Net Promoter Score (NPS)

Unlike financial metrics, the Net Promoter Score (NPS) is a standardized market research metric that quantifies your customer's satisfaction and loyalty. The official NPS format involves asking your customers the single survey question, "How likely would you be to recommend our company, product, or service to a friend or colleague?" Respondents are then divided into groups — promoters, detractors or passives — based on their response to this question based on a scale from 0 (not at all likely) to 10 (extremely likely).

NPS takes into account only promoters and detractors. Promoters are those who respond with a score of 9 or 10, and are generally your more loyal customers who may refer others to try your product, service, or company. Detractors are those that respond with a score of 0-6, and are typically assumed to be dissatisfied customers who are unlikely to purchase from you again, perhaps even to the extent that they discourage others from purchasing from you.

Here's an example:

If 20% of respondents are detractors, and 65% of respondents are promoters, your NPS score would be 65-20 = 45.

Measuring NPS is one way SaaS companies can quickly find out which customers are dissatisfied with their product or experience. In this sense, either good or bad scores, the insights gained from asking your customers for feedback has the potential to save you considerable revenue that otherwise would have been lost to churning customers.

Many SaaS companies shy away from asking for feedback, but it's ultimately this score of customer satisfaction that allows businesses to make appropriate improvements to their product or customer experience before it's too late. So don't be afraid to send out that marketing email asking for Capterra reviews or direct feedback from your customers!

In the early stages of a new business, there may not be enough customers for an NPS score to reflect the actual sentiment. Instead, the qualitative data you obtain from your NPS can be used to clarify whether there is a suitable product/market fit. The key takeaway when it comes to NPS: the higher the score, the better!

Track These 10 SaaS KPIs on Data Dashboards with Plecto!

And there you have it — the 10 SaaS KPIs every SaaS manager and entrepreneur should be measuring in 2024.

Whether you're a small business, these are commonplace or you just needed a refresher — it's important that you are measuring the KPIs that contribute the most to your business growth. While this is a great place to start, to see actual results, you need to actually use this data! There's no point in tracking these metrics if you're not going to do anything about them.

The best way to do this is to centralize all your KPI data you're tracking from your telephony, sales, support, and marketing software and systems. Then visualize them on data dashboards that transform this complex information into easy-to-understand charts that your employees can actually use!

Sign up for a 14-day free trial with Plecto, start visualizing your most important KPIs on data dashboards, and skyrocket your SaaS company targets starting today!