The global insurance market is forecast to keep growing at an annual rate of 9% in the upcoming years. After the pandemic, customer preferences have shifted, and new opportunities and threats have appeared on the market. As demand grows, competition becomes more intense and to remain competitive, insurance companies need to find new ways to engage with customers.

What is insurance selling?

Insurance sales are the process of selling different insurance products and services to B2C and B2B customers. Insurance companies can sell a variety of products and services that are meant to protect against unplanned events, financial losses of tangible and intangible assets, and unplanned personal events like illness, accidents, or personal losses.

The insurance selling process is complex, and significant effort is required to reach targeted customers. It involves customer analysis and preferences and explaining and guiding customers through complex insurance policies. Post-sale service is also a vital element that helps retain customers. This can include support, policy renewals, claims processing, and assistance with policy changes.

In short, insurance selling involves marketing and sales and requires a lot of preparation and planning.

Insurance market challenges

It is difficult to determine how to sell insurance and increase market share due to market obstacles. It is essential to note that market competition and various government regulations have an impact on the insurance industry. For example, increasing competition makes customers more price-sensitive. The number of customer exceptions is growing, and they desire more personalized options that meet all of their requirements.

This era is also characterized by a rise in technological prowess across all industries. It shows the difficulty of transitioning from traditional insurance products to modern ones, which require more complex solutions. Insurance should manage massive and catastrophic events such as natural diseases, cyberattacks, loss of assets, and a great deal more, which necessitates a higher level of knowledge.

Importance of increasing sales in the insurance industry

Companies naturally want to do the best they can with their sales. By coming up with the right strategies, your insurance company can grow and boost your sales performance. This will give you the chance to improve your offerings and provide your customers with more value. Increasing sales also means getting more customers, giving you a bigger share of the market. Also, it makes your brand seem more trustworthy, in turn attracting even more new customers and keeping the ones you already have. Diversifying can also help insurance companies lower their risks and protect them from taking on bigger losses.

Build your first dashboard.

Start your 14-day free trial today

Struggling to come up with ideas for how to boost your insurance sales? This complete guide will provide you with ideas on how to sell insurance at your agency. You will undoubtedly be able to increase your sales after reading this article!

Step 1: Analyze your customer.

Achieving your sales objective should begin with the creation of essential milestones. To initiate effective sales, you must determine what "pain" your customers are experiencing and what value you can offer to resolve it. That's the first step in learning how to sell insurance successfully. Firstly, identify the most profitable and desired market niche first. You can choose your consumer segments based on a variety of criteria, including age, gender, marital status, occupation, and income.

For example, let's look at the demographic of age. Younger customer segments are more likely to be purchasing their first assets, such as a house or a car, which requires investments and savings. When it comes to older customer segments, it is natural to stress the benefits of health and life insurance.

Remember, if you want to be an effective insurance salesperson, you must always stay one step ahead and understand what risks your potential client may face, since this is where the true value lies. Flexibility is the answer to the dilemma of how to sell insurance, because, as we've already hinted, being able to tailor your offering will help you appear more attractive to customers.

Step 2: Develop a sales strategy.

After evaluating your preferred customer segment, you can begin developing your sales strategy. Focusing on a specific customer segment requires research into the state of the market as well as keeping an eye on your competition. An examination of the external environment will aid in defining the market position and establishing a sales goal and value proposition. Perhaps it would be a good idea to evaluate your historical data in order to figure out what is achievable in the future when setting your future goals, while developing a value proposition and defining your uniqueness in the insurance market. There are numerous propositions to consider, such as innovative product offerings, competitive pricing, or a niche product that will only be available through your company.

Setting goals should not be considered a formality; if you want to properly monitor your sales strategy, you must establish necessary sales targets and metrics to aid in evaluating your sales performance. You can track various insurance KPIs to help you meet sales targets and increase insurance selling!

Step 3: Build a strong relationship with customers.

Let us continue our guide on how to sell insurance with suggestions for developing strong customer relationships. To begin, it is critical to emphasize that a strong customer base will foster trustworthiness and help to build a strong brand image. Customers now want efficiency and don't want to waste time on unimportant details. Begin with the most popular marketing channels, such as Facebook, Instagram, LinkedIn, or Twitter. Through these channels, you can promote insurance products or services, share real-life stories and promote your value, and provide advice and top tips to potential customers.

It is critical to highlight that insurance services are not easily understood. Create a simple, user-friendly website that contains all of the necessary information. On a single page, provide straightforward information about what your packages cover, its pricing, and all the detailed information.

However, having well-designed and informative online channels is insufficient. Provide online customer service and respond to customer inquiries as quickly as possible to build strong customer relationships.

Step 4: Grow your customer base and retain it!

Currently, you may wish to start saying, "Finally! Success!" Even if you have sold numerous insurance policies, you are not yet finished. The difficulties begin when you must save and retain customers. You must constantly generate new strategies for selling insurance and expanding your customer base.

If you conducted proper market research at the beginning, it must be continually updated, and your offerings must reflect the current market conditions. By designing effective marketing campaigns, you can recommend upselling and cross-selling to your customers. Retain your customers by recommending loyalty programs, unique insurance policy add-ons, and personalized offers. We must emphasize that referrals can also be crucial to your success. This, however, depends on the services you provide to clients from the very first minute. Staying current with the market and consumer trends will help you maintain a dominant market position.

Step 5: Include CRM in your process.

Online channels not only changed how customers shifted their purchasing habits but also enabled businesses to collect more accurate information regarding customer preferences, trends, and purchasing patterns. If you are thinking about how to sell insurance more profitably, let us introduce CRM systems. Having an up-to-date CRM system is the key to selling more effectively. Updating your CRM system with the most recent data provides your insurance company with numerous advantages, such as the ability to identify customer preferences and trends. This will allow you to create personalized offers for your customers and enhance their shopping experience.

Additionally, sales will improve with effective management. CRM is an essential tool for selling insurance because it involves lead management, customer qualification, and customer retention. CRM is a must-have system for any insurance company because it automates a large number of "routine" tasks, such as sending follow-up emails or newsletters to various customer segments.

CRM centralizes all your information, allowing you to optimize your sales cycle due to the centralized structure of the information. Keeping all the information you need up to date will not only save you time, but it will also help you increase profits!

Track your insurance selling progress with Plecto!

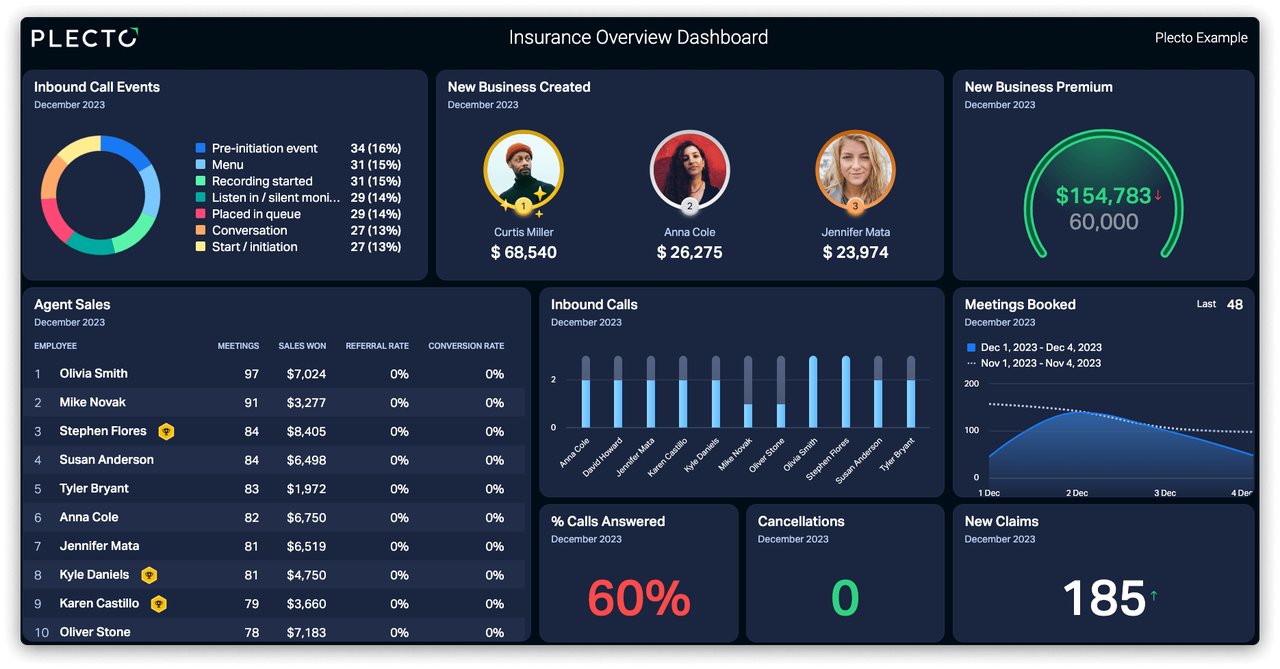

Become more efficient and integrate your CRM insurance agency data into Plecto dashboards! Track and monitor your chosen insurance sales KPI metrics and see real-time changes. We've already discussed how having and updating your CRM can provide enormous benefits to your business, but by combining it with Plecto, your insurance sales will skyrocket! At Plecto, we integrate with over 100+ systems, including some of the biggest CRMs, and all the data can be converted into engaging dashboards! Design your dashboard as you wish and add powerful widgets to help you track your insurance selling progress.

Thinking about how to sell insurance products more effectively? Motivated employees are the key to sales success! Add gamification elements or sales contests to spark a competitive spirit and add rewards for bringing more motivation.

Additionally, we have a practical feature for your business: automated reports. which can be scheduled and made when you need it with only a few clicks!

Start improving your insurance selling now!

Try out all the features; it will change your perspective on how to increase insurance sales! Sign up for a 14-day trial to notice the increase in your insurance sales!