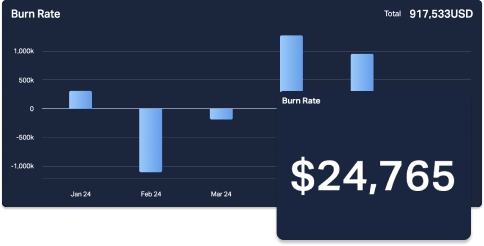

Burn Rate describes how rapidly a nonprofitable company is losing (‘burning’) cash per month. This is a KPI often applied to scenarios in science and tech startups, where the new company is operating on venture capital and hasn’t yet turned a profit. Burn Rate is naturally of particular interest for managers and investors alike, as it determines the fledgling company’s ‘runway’ – that is, the amount of time before the company runs out of money.

Burn Rate is an important KPI for your finance team to monitor.